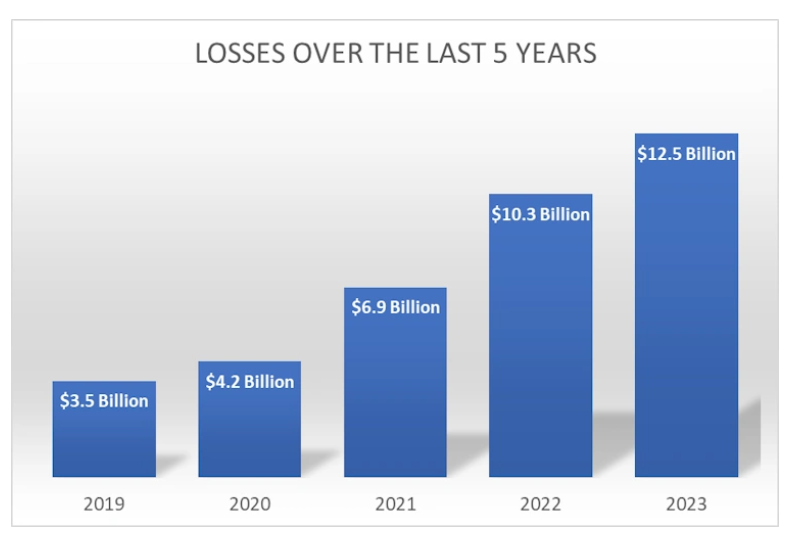

In an age where digital transactions are the norm, wire transfer fraud has become an alarming reality. Over the past five years, this type of wire fraud has surged, causing more than $37 billion in losses. As scammers continue to steal, and technology advances, it’s crucial for everyone to understand the dos and don’ts of safeguarding their money. Here is how to protect yourself, your family and you assets.

Dos

Don'ts

- Do Verify Requests:

- Always confirm requests for wire transfers through a trusted source. Call the person or organization directly using a known phone number, not the one provided in the email or message. DO NOT let them call you. Use a known number and talk to a familiar voice.

- Do Use Secure Methods:

- Use secure methods of communication when discussing sensitive information. Consider using encrypted emails or secure messaging apps.

- Do Educate Yourself and Your Team:

- Regularly educate yourself and your employees about the latest scams and tactics used by fraudsters.

- Do Monitor Accounts:

- Regularly check your bank accounts for unauthorized transactions. Report any suspicious activity immediately.

- Do Implement Security Measures:

- Use two-factor authentication for your bank accounts and ensure that your software is up to date with the latest security protection.

- Do Pay by Credit Card:

- All major credit cards have rebursts and anti-fraud protections.

- Don’t Rush Decisions:

- Avoid making hasty decisions when it comes to wire transfers. Take your time to verify the legitimacy of the request and if it sounds too good to be true it probably is.

- Don’t Trust Unsolicited Communications:

- Be cautious of unexpected calls, text, or emails requesting money or sensitive information, even if they appear to come from trusted sources. With today’s technology, it’s not uncommon for deep fake videos featuring influential figures to be edited and manipulated, making it easier for scammers to create a false sense of legitimacy. Always remain vigilant and verify the source before taking any action.

- Don’t Share Sensitive Information:

- Never share sensitive information like passwords, social security, driver’s license, addresses or account numbers over electronic channels.

- Don’t Ignore Warning Signs:

- Be alert to any red flags, such as changes in communication style, urgency in the request, or discrepancies in information provided.

- Don’t Use Public Wi-Fi for Transactions:

- Avoid conducting financial transactions over public Wi-Fi networks, as they are vulnerable to fraud. Wait until you have secure access to your electronic communications.

Internet Crime Complaint Center. (n.d.). About IC3. Retrieved October 29, 2024, from https://www.ic3.gov/